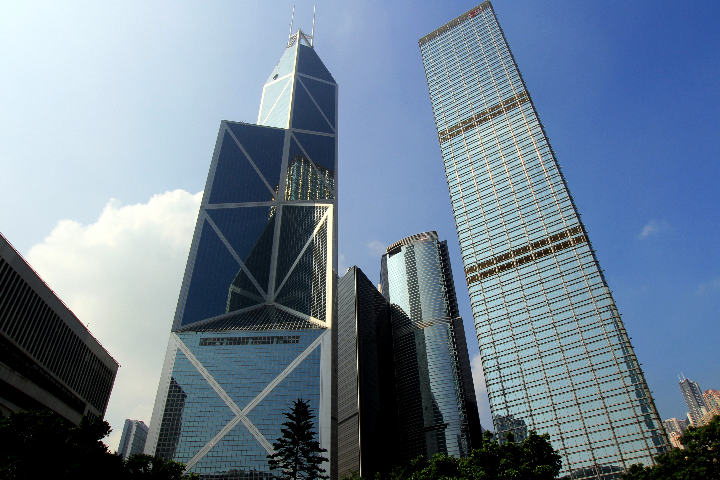

China International Capital Corp., the first Sino-foreign investment bank, and an existing shareholder raised $811 million (AED2.97 billion) from a Hong Kong initial public offering, said people with knowledge of the matter. The Beijing-based company and China’s National Council for Social Security Fund sold a combined 611.4 million shares at HK$10.28 apiece, the top of a marketed range, said the people, who asked not to be identified because the information is private. New shares account for 90.9% of the IPO, according to the prospectus. CICC and other Chinese financial firms have helped to boost Hong Kong’s IPO volume to $26.2 billion this year, up 46% from the same period of 2014, according to data compiled by Bloomberg. The five biggest Hong Kong IPOs this year were done by financial companies from China, the data show. The company offered shares at HK$9.12 to HK$10.28 each. Ten cornerstone investors agreed to buy $465 million of stock, or 57% of the offering. Cornerstone investors typically agree to hold on to their shares for six months in return for early, guaranteed allocation. China’s Silk Road Fund invested $100 million, while Hong Kong-based fund manager Value Partners Group Ltd. bought $50 million of shares, the prospectus shows. U.S.-based Prudential Financial Inc. purchased $25 million of stock, while an arm of state-run Xinhua News Agency committed $30 million. CICC plans to start trading on Nov. 9, according to the prospectus. A Hong Kong-based external spokesman declined to comment on the IPO. (By Fox Hu/ Bloomberg)

UK's Jaguar Land Rover to halt US shipments over tariffs

UK's Jaguar Land Rover to halt US shipments over tariffs

US starts collecting Trump's new 10% tariff

US starts collecting Trump's new 10% tariff

Nasdaq set to confirm bear market as Trump tariffs trigger recession fears

Nasdaq set to confirm bear market as Trump tariffs trigger recession fears

Dana Gas and Crescent Petroleum exceed 500M boe in Khor Mor field

Dana Gas and Crescent Petroleum exceed 500M boe in Khor Mor field